MLCC Market Analysis in Post-COVID-19 Era

Earlier this year, TechDesign has introduced an analysis of MLCC demand and supply. In that article, the characteristics of MLCC such as low cost, flexibility in size and the ability to sustain high voltages have been addressed; in 2025, the projection of USD 15.75 billion dollars in MLCC market with the volume of 5 trillion units has been estimated by Reportlinker as well.

To describe the market more, capacitors account for 66% of RCL passive components; ceramic capacitors account for 50% of capacitors; and MLCC account for 93% of ceramic capacitors. According to the largest MLCC supplier Murata, the development trend of MLCC should be high capacitance and miniaturization; operating at high pressure, high frequency, and high temperature. Murata further indicates different MLCC usages in various applications.

| Application | MLCC (pcs) |

|---|---|

| Automobile | 3,000 ~ 20,000 |

| Smartphone | 800 ~ 1,000 |

| Laptop | around 800 |

| Tablet | around 600 |

| Digital TV | around 600 |

| Smart watch | around 200 |

Demand side:

From MLCC demand and supply analysis, consumer electronics plus other 5G related applications would include more than 80% of the MLCC market demand; therefore, the status of 5G base stations and smartphones will be updated below.

Since the epidemic of COVID-19 in China has got eased, the component production of 5G base stations is getting better. In announcement to public, China has planned to build more than 600,000 5G base stations by 2020. Besides, COVID-19 brings chances of 5G demand including telehealth and telecommunication, etc.

On the other hand, Strategy Analytics has decreased the 2020 smartphone shipment estimation from 1.36 to 1.09 million units with a reduction of 23% comparing to 2019. That is to say, the usage of MLCC in terms of smartphone application will also decrease severely. However, the demand of smartphones is believed to return back to normal in the long run; Murata predicts the MLCC usage of smartphones in 2024 will be 1.5 times more than that in 2019.

Supply side:

Recently, the MLCC volume impact of COVID-19 has gradually resumed in the supply side although the productivity has not been completely recovered and the effect of COVID-19 is still difficult to explicitly determined. Due to the decrease of supply, the prices of MLCC remain solid and several suppliers keep the raised prices. However, in comparison with earlier this year, the demand and supply have come to a more balanced status.

As previously addressed, the main suppliers of MLCC include Murata (Japan), SEMCO (Korea), Taiyo Yuden (Japan), Yageo (Taiwan), Walsin (Taiwan) and TDK (Japan). These suppliers from Japan, Korea and Taiwan have already occupied around 80% of the MLCC supply.

The MLCC volume of Murata is around 150 billion pcs/month under normal conditions. From the information in May, factories in Japan have fully resumed production by now, but factories in China, Malaysia and the Philippines have merely resumed partial production due to the government and epidemic constraint. Factory full production in the Philippines is targeted in August. Murata has predicted that its revenue of capacitors in 2020 will be similar to that in 2019.

For SEMCO, the MLCC volume is usually around 100 billion pcs/month. SEMCO has announced that its MLCC inventory level would fall from 45 days in 1Q20 to 40 days (or less) in 2Q20 due to the gradual recovery of production. However, the output disruptions in China, Japan, Malaysia, and the Philippines are inevitable. It predicts a solid demand on PC, server and networking markets and a weak demand on mobile electronics.

Normally, Taiyo Yuden produces 50 billion MLCC pcs/month in its factories. Since the influence of COVID-19 epidemic has become mild, factories in Japan, Korea, China and Thailand have operated back to normal, yet the factory in Malaysia operates partially with government restriction. The revenue in first half of 2020 increases 3.4% year over year.

The MLCC production volume of Yageo is close to Taiyo Yuden, which is around 50 billion MLCC pcs/month. The factory operation in China has got back to 60%, which has improved a lot from 30% during the previous Chinese New Year. Besides, the status in Taiwan is normal. Yageo acts conservative for 3Q20 and is planning to continuously transform to high end products. Volume expansion will be implemented in the end of 2020 and the target will be 57 billion MLCC pcs/month.

In general, Walsin produces 50 billion MLCC pcs/month. Factories in China and Taiwan have completely resumed the operation but factory in Malaysia has partially resumed the operation only. The work resumption has improved from 50~60% in 1Q20 to 80~90% totally. Walsin focuses on stable business growth and predicts approximately same sales performance in supply in 3Q20 comparing to 2Q20.

| Supplier | MLCC capacity in normal conditions (pcs/month) | Factory status |

|---|---|---|

| Murata | around 150 billion | Factories in Japan have fully resumed production, but the factories in China, Malaysia and the Philippines have merely resumed partial production |

| SEMCO | around 100 billion | the output disruptions in China, Japan, Malaysia, and the Philippines are inevitable |

| Taiyo Yuden | around 50 billion | the factories in Japan, Korea, China and Thailand has operated back to normal. Yet the factory status in Malaysia remains partial operation with government restriction. |

| Yageo | around 50 billion | The factory operation in China has got back to 60%, which has improved a lot from 30% during the previous Chinese New Year. Besides, the status in Taiwan is normal. |

| Walsin | around 50 billion | Factories in China and Taiwan have completely resumed the operation but factory in Malaysia has partially resumed the operation only. The work resumption has improved from 50 ~ 60% in 1Q20 to 80 ~ 90% totally. |

(Source: Caitong Securities, Murata, SEMCO, Taiyo Yuden, Yageo and Walsin)

To summarize the supply status, factory operation is continuously being recovered although the recovery rate has not yet been 100%. Major suppliers such as Murata, SEMCO, Taiyo Yuden, Yageo and Walsin remain positive toward the MLCC market in the long run.

TechDesign provides multiple MLCC selections at Walsin and PDC

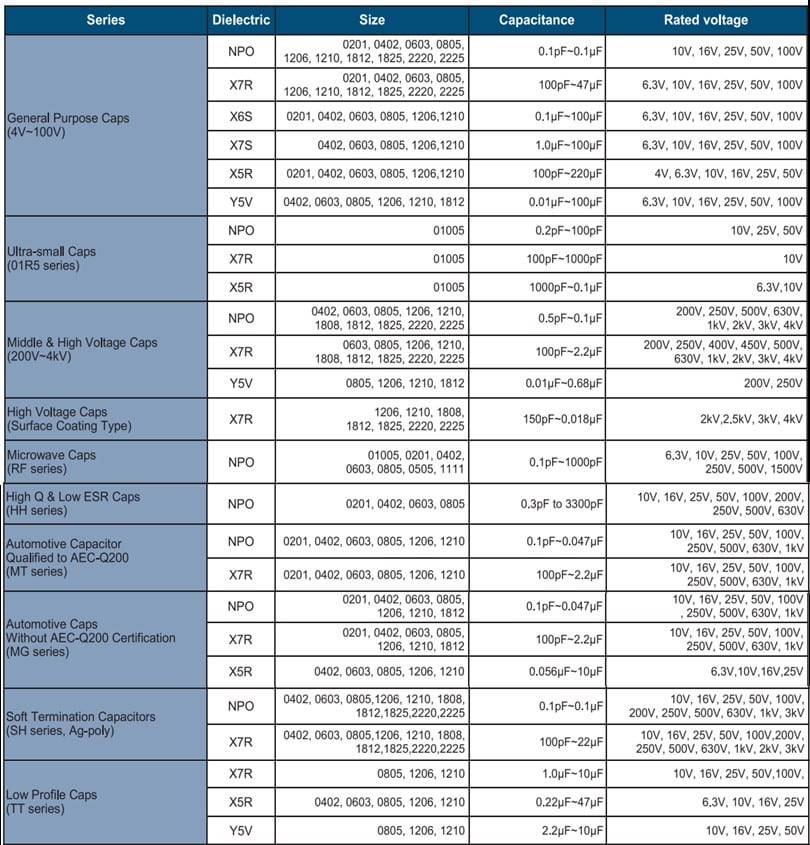

At TechDesign, one could find multiple MLCC selections in the e-Stores of Walsin and PDC (Prosperity Dielectrics Co., Ltd.). Walsin provides complete MLCC product series including general purpose, ultra-small, microwave, high Q and low ESR, automotive, soft termination, and low profile MLCC, with a variety of dielectrics, sizes, capacitances and voltages.

PDC also provides different kinds of MLCC product series which are listed below. Common-used general purpose MLCC, safety certificated, mid-voltage, high voltage, anti-bend and high capacitance MLCC are all available for customers to choose from.

| Product Series | Series Code | Dielectric | Size | Rated Voltage |

|---|---|---|---|---|

| Safety Certificated MLCC | FH & FK | C0G(NPO)/X7R | 1808 ~ 2220 | 250 VAC |

| Mid-Voltage MLCC | FM | COG(NPO)/X7R/Y5V | 0402 ~ 2225 | 100 ~ 630 VDC |

| General Purpose MLCC | FN | C0G(NPO)/X5R/X7R/Y5V | 01R5 ~ 2225 | UR ≦ 50V |

| Anti-Bend (Soft termination) MLCC | FP | COG(NPO)/X7R | 0603 ~ 2225 | 25 ~ 4KV |

| High Capacitance MLCC | FS | X5R/X7R/Y5V | 0402 ~ 2225 | 4 ~ 630 VDC |

| Extra High Voltage MLCC | FV | C0G(NPO)/X7R | 0805 ~ 2225 | ≧ 1K VDC |

Conclusion

The demand of 5G base stations is estimated to rise back since the component production is getting better, but the demand of smartphones in 2020 is predicted to decrease from 1.36 to 1.09 million units by Strategy Analytics since the impact of COVID-19 is severe. The whole demand of MLCC market is still affected by the epidemic. In the supply side, factory operation for main suppliers such as Murata, SEMCO, Taiyo Yuden, Yageo and Walsin is continuously being recovered, and it will surely stabilize the condition of supply.

Overall, the demand and supply have come to a more balanced state. And in the long run, the market should grow steadily due to the strong demand of 5G and automobile applications. Here at TechDesign, one could find complete MLCC products at Walsin and PDC. Come visit TechDesign right now and let us help you get what you are looking for!