2020 MLCC Demand and Supply Analysis

MLCC (Multi-layer ceramic capacitors) is first introduced in 1961 and were only more widely used in the past decades. To stack multiple capacitors together into a single package minimizes the circuit space and simplifies the circuit design. Besides, MLCC is low cost, having the flexibility in size and the ability to sustain high voltages. Because of the above advantages, MLCC is used much more often than other kinds of capacitors recently. In this article, the current trend of supply and demand of MLCC market will be discussed.

The market of MLCC is estimated to achieve USD 15.75 billion dollars with the volume of 5 trillion units by 2025, rising from USD 9.93 billion dollars with the volume of 3.94 trillion units in 2019, referring to Reportlinker, the technology company which provides the market research information. However, the outburst of COVID-19 (Coronavirus) has severely affected both demand and supply side; it remains uncertain whether or not MLCC market will downsize this year.

Demand Side: 5G is the Key Factor

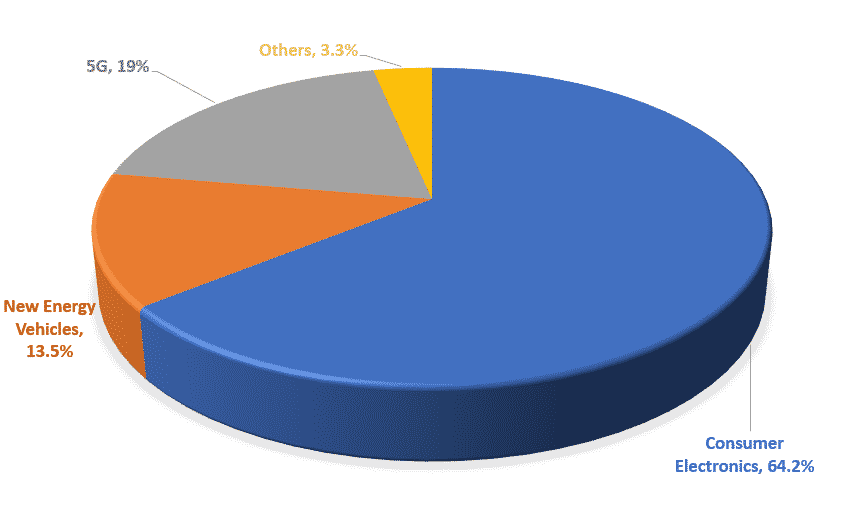

MLCC could be adopted in various applications such as consumer electronics, automotive, 5G, industrial, IoT, and military applications. Consumer electronics, which occupy the largest portion of MLCC, account for 64.2% of the market; other driving forces would be new energy vehicles (including electric vehicles) and 5G base stations.

5G technology has always been discussed as an important driving force for MLCC, from 5G smartphones to 5G base stations. Unfortunately, the key components of 5G base stations like optical fibers or PCB are basically manufactured in China, especially in Wuhan, Hubei, where COVID-19 originally happened; thus, the negative effect of 5G base station built up is expected undoubtedly.

The delay of 5G base stations will also limit the growth of the fast rising 5G smartphones, which is another main momentum for MLCC. For instance, 5G smartphones which support sub-6GHz frequency band will need 10~15% MLCC more than those of 4G smartphones; and 5G smartphones which support mmWave will need 30~35% MLCC more than those of 4G smartphones. In estimation, each 5G smartphone will need more than 1000 units MLCC in the future.

Therefore, Strategy Analytics has decreased the forecast of 5G smartphone shipments to 199 million units, and the forecast of overall smartphone shipments to 1.36 million units in 2020, with a 3.6% reduction in comparison to 2019. As what was mentioned above, since 5G smartphones need to be equipped with more MLCC than 4G smartphones, the total MLCC shipments based on smartphone demand will remain almost the same (or even slightly decrease) in 2020 comparing to 2019.

| Smartphone | shipments | |

|---|---|---|

| 2019 (Mu) | 2020 (Mu) | |

| 5G | 19 | 199 |

| Others | 1394 | 1165 |

| Total | 1413 | 1364 |

Table 1. Smartphone shipment in 2019 and estimation in 2020 (Source: Strategy Analytics)

Supply Side: Key Players are All in Asia

Although the demand of MLCC will be projected to shrink somehow due to the negative effect of COVID-19, it will still exceed the total amount which suppliers could offer. MLCC market has already in shortage of supply since 2017, and with the disturbance of COVID-19, many suppliers had not started to work until the middle of February with a lack amount of labor force, the capacity decreased further. Overall, the impact from COVID-19 on supply side is more severe than on demand side.

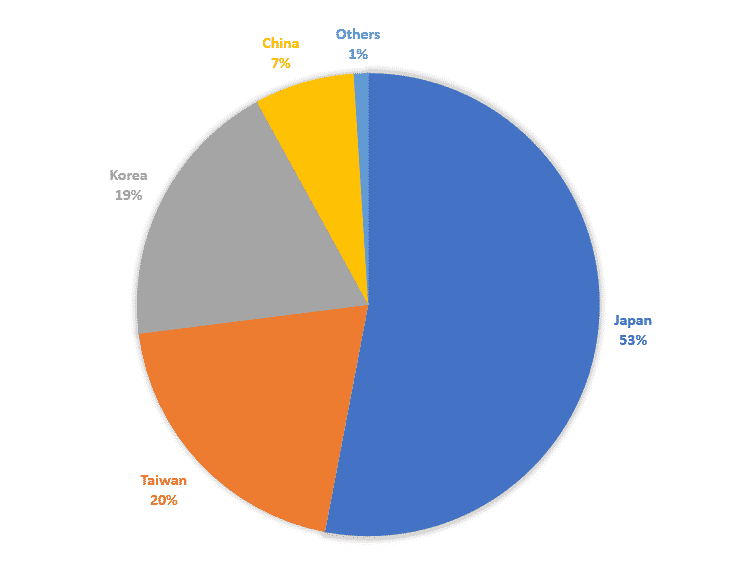

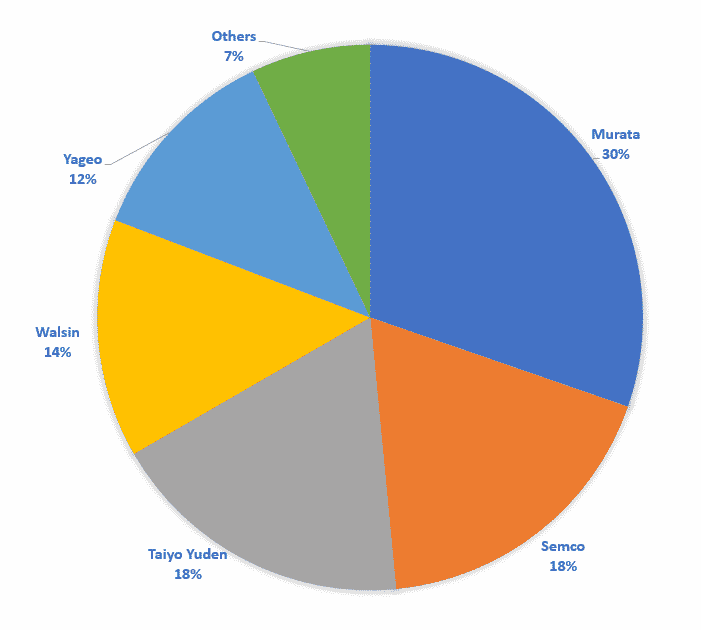

The major suppliers of MLCC market are almost from Asia, such as Murata (Japan), SEMCO (Korea), Taiyo Yuden (Japan), Walsin (Taiwan), Yageo (Taiwan), TDK (Japan) and AVX (Japan). Japanese suppliers account for 53% of MLCC market; Taiwanese suppliers account for 20%; Korean suppliers account for 19% and Chinese suppliers account for merely 7%. Nevertheless, what need to be mentioned here is that 40~50% of MLCC are made in China. Based on the information from ISTI, ITRI (The Industry, Science and Technology International Strategy Center in the Industrial Technology Research Institute), the product lines of passive components in China are typically in the east and the south.

It is all well known that China, Korea and Japan are all serious infected area of COVID-19, and the supply of MLCC surely will be constrained until the virus could be under control. Since China is the most severe country among all, the Chinese factories of those suppliers are listed below for reference.

| Suppliers | Factories in China | Accumulated confirmed cases** |

|---|---|---|

| Murata | Guangzhou and Shenzhen, Guangdong; Wusih, Jiangsu | Guangzhou: 347; Shenzhen: 418; Wusih: 55 |

| Semco | Tianjin; Kunshan*, Jiangsu | Tianjin: 136; Suzhou: 87 |

| Yageo | Suzhou and Kunshan*, Jiangsu | Suzhou: 87 |

| Taiyo Yuden | Dongguan, Guangdong | Dongguan: 99 |

| TDK Corp. | Suzhou and Wusih, Jiangsu; Xiamen, Fujian; Dongguan, Guangdong…… | Suzhou: 87; Wusih: 55; Xiamen: 35; Dongguan: 99 |

| Walsin | Shenzhen and Dongguan, Guangdong | Shenzhen: 418; Dongguan: 99 |

Table 2. Suppliers’ factory distribution in China and COVID-19 accumulated confirmed cases

*Kunshan is a country-level city under the administration of Suzhou

**Statistics to AM 9:45, 3/6/2020

Moreover, the constraint of supply may affect the price of MLCC. Take Taiwanese supplier Yageo as an example. The MLCC stocks of Yageo has decreased to less than 1 month, and Yageo has already risen 50~60% of the MLCC price from March. Another Taiwanese supplier Walsin indicates less impact comparing to Yageo and is not intended to increase the price of MLCC currently. For Walsin, the top priority is to stabilize the balance between supply and demand.

TechDesign provides multiple MLCC selections at Walsin and PDC

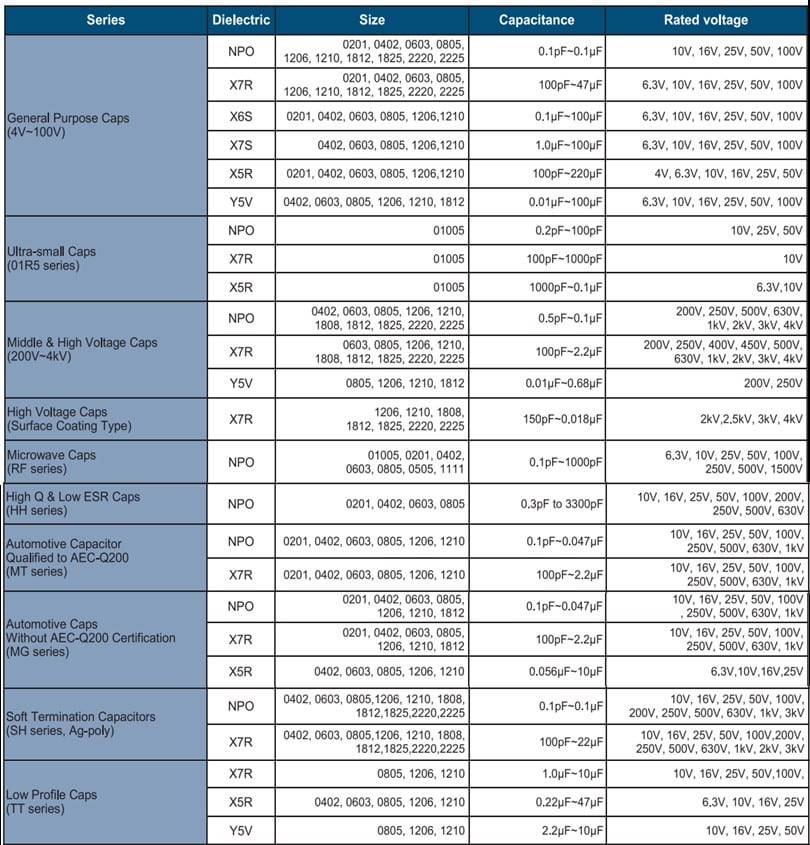

At TechDesign, one could find multiple MLCC selections in the eStores of Walsin and PDC (Prosperity Dielectrics Co., Ltd.). Walsin provides complete MLCC product series including general purpose, ultra-small, microwave, high Q and low ESR, automotive, soft termination, and low profile MLCC, with a variety of dielectrics, sizes, capacitances and voltages.

PDC also provides different kinds of MLCC product series which are listed below. Common-used general purpose MLCC, safety certificated, mid-voltage, high voltage, anti-bend and high capacitance MLCC are all available for customers to choose from.

| Product Series | Series Code | Dielectric | Size | Rated Voltage |

|---|---|---|---|---|

| Safety Certificated MLCC | FH & FK | C0G(NPO)/X7R | 1808 ~ 2220 | 250 VAC |

| Mid-Voltage MLCC | FM | COG(NPO)/X7R/Y5V | 0402 ~ 2225 | 100 ~ 630 VDC |

| General Purpose MLCC | FN | C0G(NPO)/X5R/X7R/Y5V | 01R5 ~ 2225 | UR ≦ 50V |

| Anti-Bend (Soft termination) MLCC | FP | COG(NPO)/X7R | 0603 ~ 2225 | 25 ~ 4KV |

| High Capacitance MLCC | FS | X5R/X7R/Y5V | 0402 ~ 2225 | 4 ~ 630 VDC |

| Extra High Voltage MLCC | FV | C0G(NPO)/X7R | 0805 ~ 2225 | ≧ 1K VDC |

Table 4. The product series and specifications of PDC (Source: PDC)

Conclusion

The main driving force of MLCC market in 2020 are projected to be 5G smartphones, 5G base stations, and new energy vehicles. Sadly, being influenced by COVID-19, the estimated demand may be lower comparing to the previous estimation. The scale of impact should be clearer only after the epidemic is under control.

Although the demand of MLCC will decrease, the MLCC market is still extremely tight in supply. The reason is that most of the suppliers are from Asia infected areas, and COVID-19 affects supply side more seriously than demand side. The capacity was already tight before and even tighter now because many suppliers had not started to work until mid-February with insufficient labor force.

Despite of the unstable and uncertain market condition, the demand of MLCC still exceeds supply. Here at TechDesign, one could find complete MLCC products at Walsin and PDC. Let TechDesign helps you to get what you are looking for; come shop for MLCC right now!